In the realm of business, 56 percent of companies have embraced AI in at least one function, a leap from 50 percent in the previous year, indicating a rapid adoption of technology to enhance efficiency.

The statistics speak volumes about the importance of efficient and accurate management for business, including financial management.

As the backbone of any enterprise, financial management ensures that resources are allocated effectively with minimized risk and long-term stability.

Unfortunately, what is happening on the ground portrays a different reality for those having poor management systems.

Some unlucky accountants have to face daily challenges such as:

- The meticulous scrutiny of numbers,

- The relentless pursuit of accuracy,

- And the constant pressure to comply with evolving financial regulations.

Accounting is a balancing act that demands precision and efficiency.

Hence, an ERP system is not just a tool but an ally on the financial battlefield.

With features like automated ledger entries, error detection algorithms, and compliance monitoring, ERP systems enable businesses to uphold the highest standards of financial integrity.

They free accounting departments everywhere from the drudgery of manual processes, allowing them to focus on strategic analysis and foresight.

What ERP features for accounting management could you consider implementing in your workplace?

5 Key ERP Features for Accounting

To contribute to a business’ growth, accountants must analyze financial trends, provide strategic insights, and engage in more value-added activities that contribute to the company’s strategic decision-making. Let’s start with the basics.

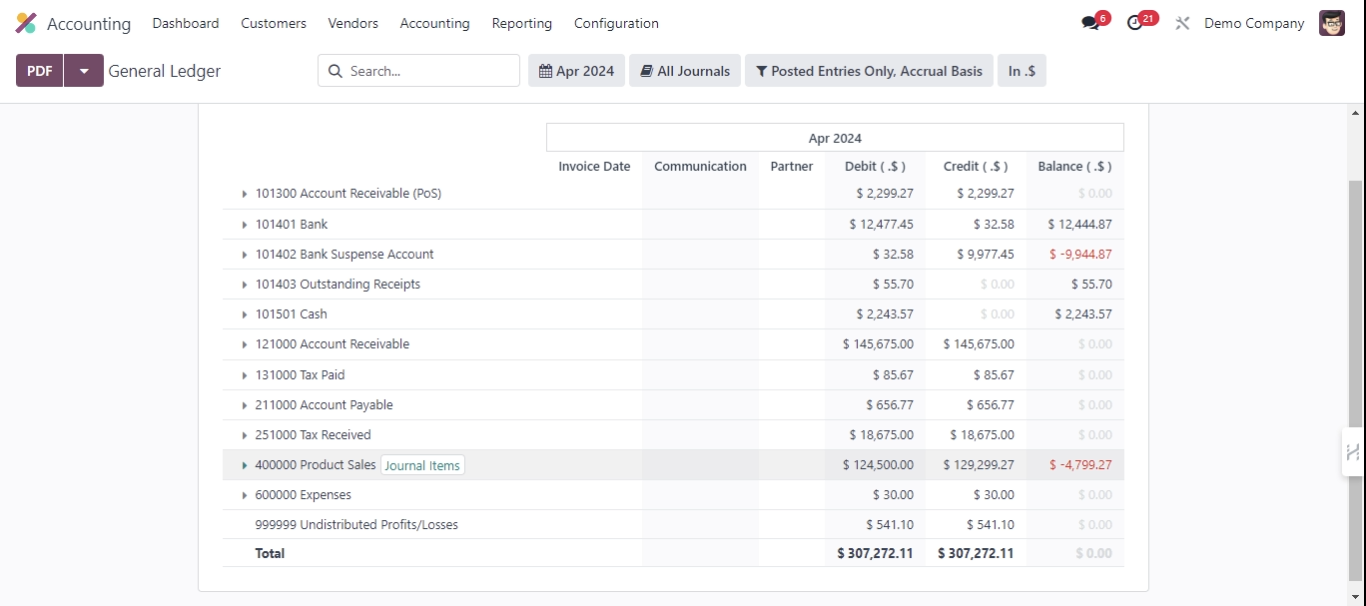

1. Financial Management and General Ledger

In today’s globalized economy, financial management is not just about balancing the books; it’s about gaining a strategic advantage.

An integrated financial management system within an ERP solution provides a unified platform that ensures accuracy and gives a real-time view of your financial health, enabling you to make informed decisions swiftly.

Multi-currency and multi-company support is highly necessary for professionals dealing with international transactions.

If you find an ERP system that offers this feature, rest assured your financial data will stay consistent, compliant, and current with the latest exchange rates.

You don’t want to install an ERP and still have to convert different currencies manually per transaction.

We can agree that organized and transparent reporting IS the heart of any financial operations. Undoubtedly, one of the most essential ERP features for accounting management that you should consider is financial reporting and analysis.

The feature enables you to say goodbye to the days of sifting through spreadsheets and disparate data sources and say hello to a streamlined report.

When considering an ERP, you should find the features that align with your business goals. For instance, if you need an all-in-one reporting and analysis tool, Odoo would be the perfect fit. The software integrates all your financial data, providing customizable reports at the click of a button.

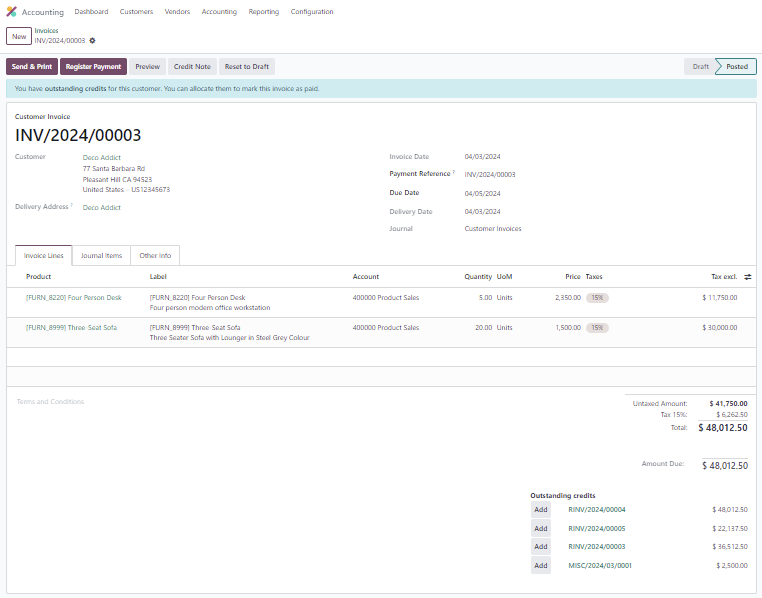

2. Accounts Payable and Receivable

If you need help with your accounts payable and receivable visibility, you are not alone.

According to a 2022 Ardent Partners report, a staggering 45% of businesses report having too many exceptions in their accounts payable.

It stresses the need for visibility to tackle errors and payment delays. A way to gain control and improve visibility is through centralized accounts payable and receivable management.

Centralized accounts payable and receivable management provides a single source of truth, eliminating the silos of information that can lead to discrepancies and inefficiencies.

An accountant’s two nightmares are:

- Finding non-accurate payments, and

- Being unable to detect fraud.

To mitigate this, most ERP features for accounting provide automated invoice processing and matching in their Accounts Payable and Receivable capabilities.

Its primary function is to reduce the manual labor associated with invoice handling to minimize error. Just ensure the ERP you chose extends the matching of invoices with your purchase orders and receipts.

Pro tip: If you want better negotiation terms, improved service levels, and a stronger bottom line, take advantage of the vendor relationship manager (VRM) and customer relationship management (CRM) built-in within the ERP. Imagine it as a bridge that connects a company with its vendors and customers.

- In Accounts Payables (AP), effective VRM leads to improved negotiation terms, timely payments, and better cost management, which in turn can prevent late payment penalties and secure favorable pricing for your company.

- On the other hand, the benefits of account receivables (AR) are shown through enhanced customer satisfaction. Prompt invoicing and transparent payment processes benefit not only accountants but also businesses by increasing loyalty and repeating business.

We mustn’t forget that foresight is just as invaluable for maintaining operational continuity and capitalizing on investment opportunities.

Make sure to include cash flow forecasting and management as one of your pre-requisite AP and AR ERP features for accounting management. This crystal ball that offers foresight into the financial future provides tools that enable businesses to anticipate cash needs and manage liquidity effectively.

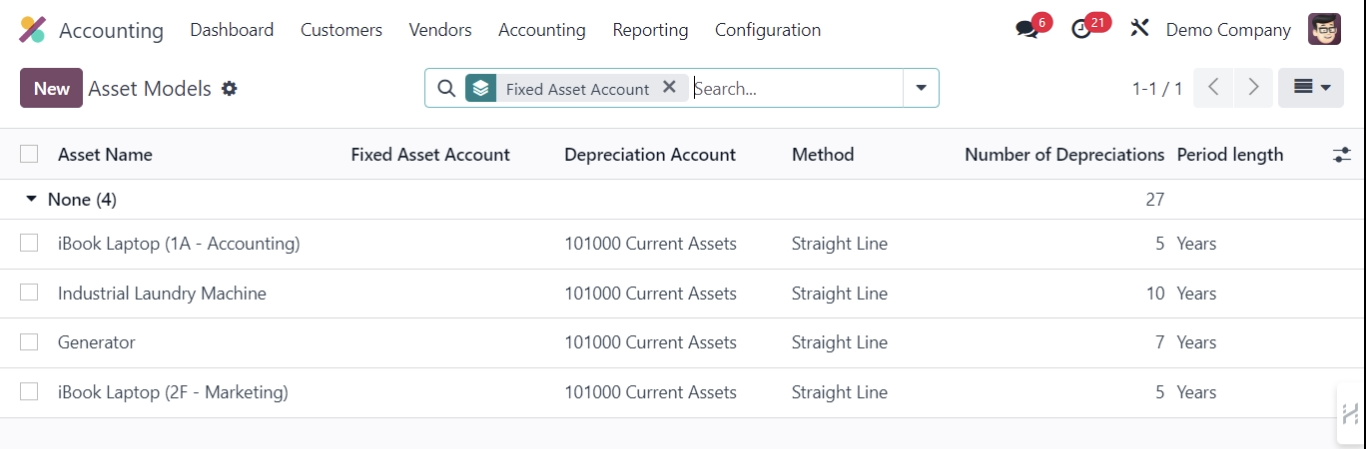

3. Fixed Asset Management

Asset tracking and lifecycle management in an ERP system provide a comprehensive view of an asset’s journey from acquisition to disposal. It’s how you know all assets are accounted for and properly managed throughout their lifecycle, leading to improved asset utilization and cost savings.

As accountants, you probably would benefit from an automatic depreciation calculation in an ERP’s fixed asset management feature.

Having an ERP regularly update your accounting system when tax laws change becomes the fundamental difference between dedicated fixed asset systems and add-on modules from ERP vendors.

Suffice it to say that the system automates complex calculations and ensures compliance with accounting standards without performing manual calculations for each item.

Speaking of assets, it is a good idea to have an ERP that enhances asset maintenance and insurance management through its fixed asset management feature.

It’s because the system offers a centralized platform for scheduling maintenance and managing insurance policies, reducing the risk of asset downtime and ensuring that assets are adequately insured.

Integrating accounting and tax records with your ERP can save time when compiling your annual reports. But how can it benefit you in fixed asset management?

- Reduced Duplication: Maintaining a book and tax asset basis in two separate systems requires that all activity in each period be recorded twice. Integration reduces this duplication of effort and the time it takes to input asset information.

- Improved Visibility: When asset management is integrated with an ERP system, managers can get deep visibility of assets. It allows decision-makers to make better choices about assets related to asset lifecycle, and maintenance.

- Efficient Data Transfer: Some ERPs can transfer fixed asset data among the fixed asset system, the General Ledger (GL), and other business functions, such as Accounts Payable (AP) and Purchasing.

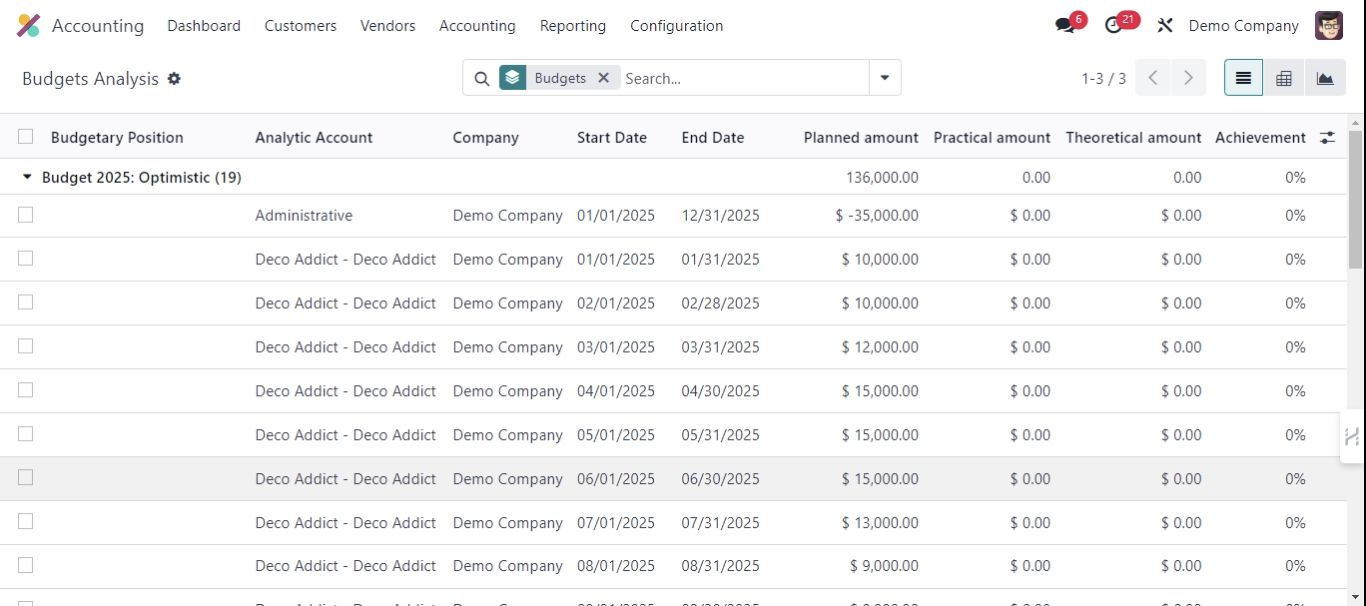

4. Budgeting and Forecasting

When it comes to budgeting and forecasting, an ERP provides comprehensive tools for all your needs, making it a must-have for your business. Yes, it streamlines your budgeting process by automating many things, including data collection, consolidation, and reporting.

But the real winner is that ERP systems have the perfect environment for cross-departmental collaboration so that you can share budget plans and forecasts.

Exploring potential outcomes by changing input values and assumptions in a financial model is just as important as being able to create multiple plausible future scenarios to anticipate possible changes. It’s because all businesses want to be able to prepare for uncertainties and still make informed decisions.

This is where scenario planning and what-if analysis come into play.

ERP features for accounting management allow users to simulate various scenarios based on demand forecasts and constraint modeling. Decision-makers can evaluate the impact of different scenarios on financial outcomes and identify potential disruptions.

Variance analysis and reporting provided by ERP software would allow you to analyze deviations between actual performance and your planned targets.

By analyzing deviations, you get to understand why your results differ from expectations and find areas where you can reduce costs and enhance your revenue. It is also beneficial in the audit season.

Some ERP capacities for accounting management come with integrating your financial data and KPIs. The integration allows businesses to monitor key performance indicators such as sales, growth, customer acquisition costs, and profitability. At the same time, make sure the financial goals align with your overall business strategy.

5. Bank & Cash Management

The struggle is real: 61% of businesses (according to the 2023 AFP Payments Survey) experienced cash flow disruptions in the past year. But what if you could gain real-time insights into your cash position and streamline your financial processes?

Here's where ERP capacities for accounting swoop in to conquer those cash flow disruptions:

- Automated Bank Connections: Gone will be the days of manual bank statement uploads. Your ERP automatically connects to your bank accounts, feeding real-time data directly into the system. This means no more waiting to understand your cash position - you'll always have a clear picture.

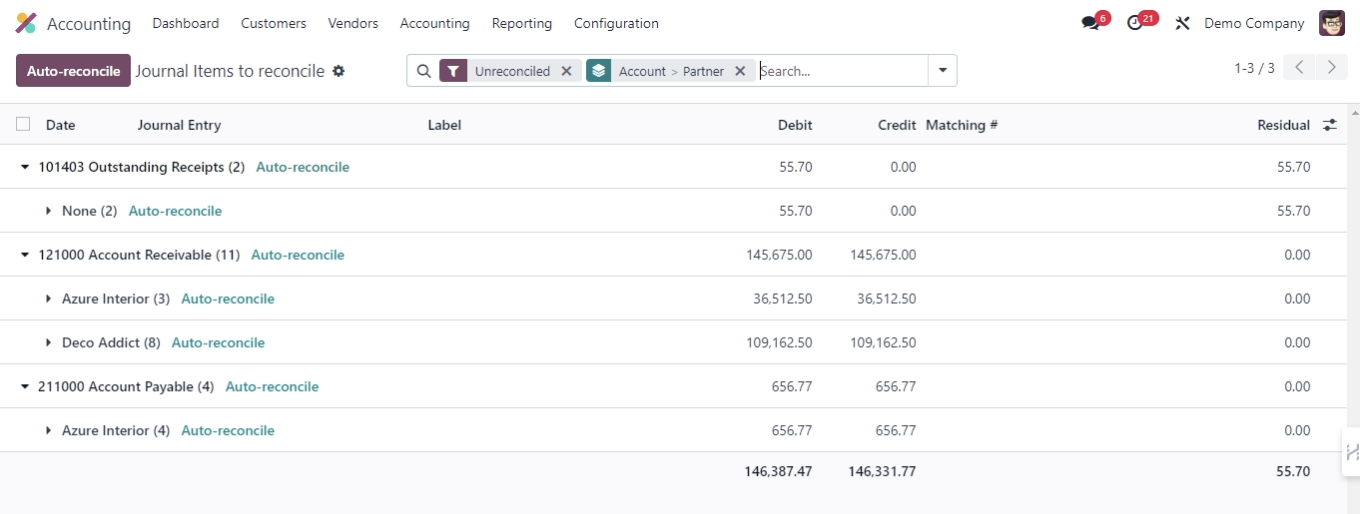

- Effortless Cash Register Management: Say goodbye to tedious cash register reconciliation. ERP will let you record and track every cash transaction, from sales to expenses. Plus, you'll have a clear audit trail for ultimate transparency and compliance. Imagine effortlessly linking those cash register transactions to your bank records for flawless reconciliation - a dream come true for any finance team!

- Ditch Manual Reconciliation Drudgery: Picture no more endless hours spent painstakingly matching up bank statements and accounts payable/receivable records that kill your KPI. Your ERP automates journal entries and reconciliation, eliminating the error-prone and time-consuming manual process.

Free your accounting team to focus on strategic analysis and value-added tasks that truly move the needle for your business.

Bonus: Integration with Other Modules

Envisage one source of truth not only for accounting but for EVERY department.

ERP capacities for accounting seamlessly integrate with other ERP modules and functions, eliminating silos and boosting efficiency. Accountants get real-time financials, while everyone gains a holistic view of the business.

But it's not just data. Regardless of what ERP features you use and how you use them, they break down communication barriers. Financial analysts get real-time insights, fostering collaboration across departments, while CFOs can receive instant reports, enabling quicker responses.

The result? Informed decisions, strategic planning, and an agile organization ready to adapt to any challenge.

Choose Odoo for Your Accounting Management

As you stand at the crossroads, considering the path to take for financial management excellence, remember that the right ERP system is more than a tool---it's a game-changer for your business.

It's time to move beyond recognizing the need for efficient and integrated financial management to implementing a solution that propels your business forward.

The key benefits of ERP systems for accounting departments are undeniable. From streamlining financial reporting and analysis to automating accounts payable and receivable processes, an ERP solution equips your business with the tools to enhance accuracy, compliance, and strategic decision-making.

With features like fixed asset management, budgeting and forecasting, and bank and cash management, you'll gain real-time insights, enabling you to stay ahead of the game.

However, it's crucial to remember that not all ERP systems are created equal. Take the time to research and compare different ERP options, such as ERPNext and Oracle Netsuite, to find the one that best fits your business requirements.

Don't settle for a one-size-fits-all solution; instead, invest in an ERP system that can be tailored to your specific needs, allowing you to maximize its potential.

Reach out to our experts or schedule a consultation. Their guidance can help you navigate the complexities of your financial management ERP implementation and ensure a smooth transition for your organization.