Gogoprint, a multinational company in Asia Pacific, faced the challenge of using different accounting systems for each country they operate in. This hindered their accountability and transparency in their operations.

Odoo Accounting stands out as the leading choice for businesses seeking the best invoicing and bookkeeping features, as exemplified by the success story of Gogoprint. Note how the major player in the APAC region's printing industry succeeded in revolutionizing its operations using Odoo ERP.

To help Gogoprint overcome its challenges, Portcities implemented a tailored accounting module that incorporates each country’s regulations and requirements. The same system is also able to consolidate Gogoprint’s regional data and enables integration with necessary third-party systems to optimize their operations and efficiency.

Let’s learn more about how Odoo Accounting software can benefit your accounting department just like it benefits the giant printing industry.

Bookkeeping empowered by Odoo for Accounting

There are five reasons why the Odoo Accounting module is great for your day-to-day accounting operations in bookkeeping:

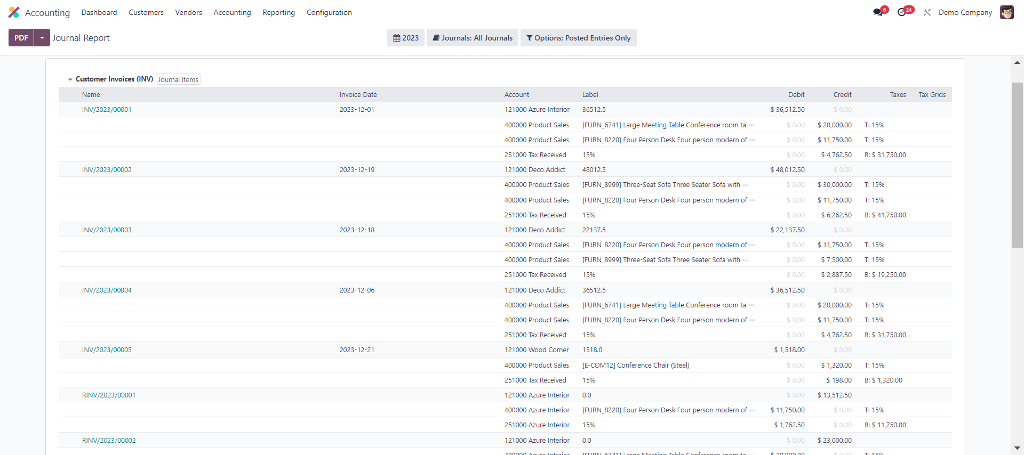

1. Journal entry

When using Odoo to make a journal entry, you will enjoy a user-friendly interface and features, such as automated posting, integration with other modules, and the ability to create recurring entries. With Odoo's intuitive design and automated double-entry bookkeeping, you can maintain accurate financial records and gain valuable insights into your business's financial health.

The automated posting ensures accurate and consistent accounting records. The integration with other modules streamlines data transfer and eliminates duplicate entries. Additionally, you can make use of the recurring entries feature to automate repetitive transactions.

2. Analytical accounts and cash flow statements

In Odoo accounting, the analytic account feature allows for tracking and analyzing financial transactions related to specific projects or cost centers. By assigning analytic accounts to journal entry lines, you can allocate transactions and generate reports for individual projects or departments.

On the other hand, the cash flow statement summarizes a company's cash inflows and outflows, categorized into operating, investing, and financing activities. It is generated based on journal entries, specifically those related to cash transactions. These two features utilize the information gained from the journal entries to provide additional analysis and reporting.

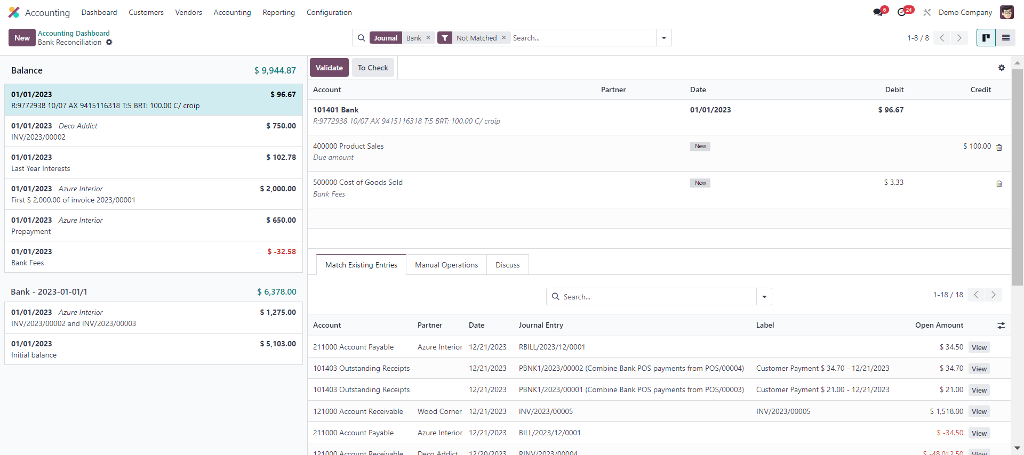

3. Bank synchronization and reconciliation

Odoo integrates with various banks and financial institutions, allowing you to connect your bank accounts and import your bank statements directly.

By synchronizing your bank statements with Odoo, you can access the actual transactions in your bank account. This data is then used during the bank reconciliation process to compare and match the transactions recorded in Odoo with those in the bank statement.

3. Tax reports and fiscal localization packages

Use Odoo accounting in any country and switch between different localizations easily. Odoo can pre-configure your database according to country-specific requirements, such as a chart of accounts and legal statements.

To top it off, the accounting module can generate tax reports based on your country’s fiscal rules and regulations. You can also configure different tax rates, fiscal positions, and tax codes for your products and customers.

To give you a head start and examples of legal and accounting localization in specific countries, check out our localization packages for our customers in Indonesia, Malaysia, Singapore, and Vietnam.

4. Inventory valuation

Odoo gives more ease to businesses facing inventory management challenges. The integration between Odoo Inventory and Accounting apps allows accurate financial reporting by providing a clear picture of inventory value on financial statements.

Inventory valuation enables you to calculate the cost of goods sold (COGS), which aids in understanding product profitability. It also helps conduct real-time inventory tracking, assisting you in optimizing inventory management processes, identifying slow-moving items, and improving your business’ cash flow. Plus, your product costs can provide insights that will enhance your cost control.

Learn more about how Odoo apps can help you solve your logistics needs.

Invoicing using the Odoo Accounting Module

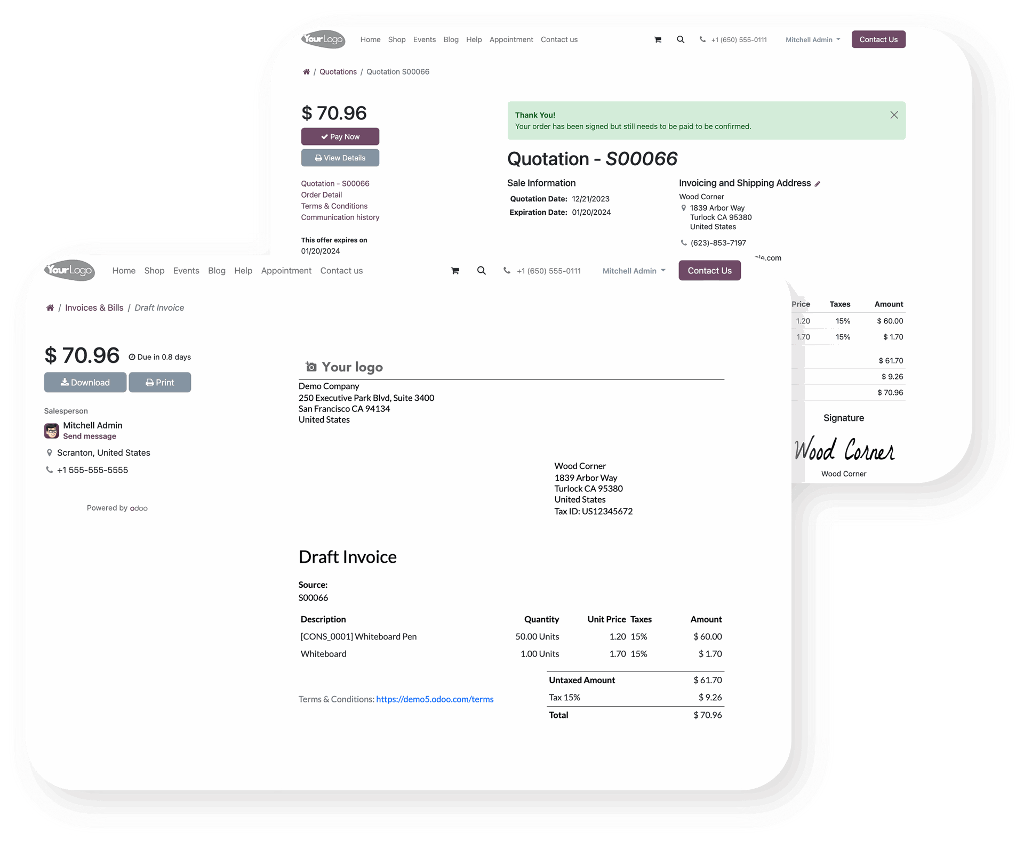

Odoo for accountants is more than just a software solution. With Odoo for accountants, you can easily create and manage invoices for your customers using the powerful Odoo module.

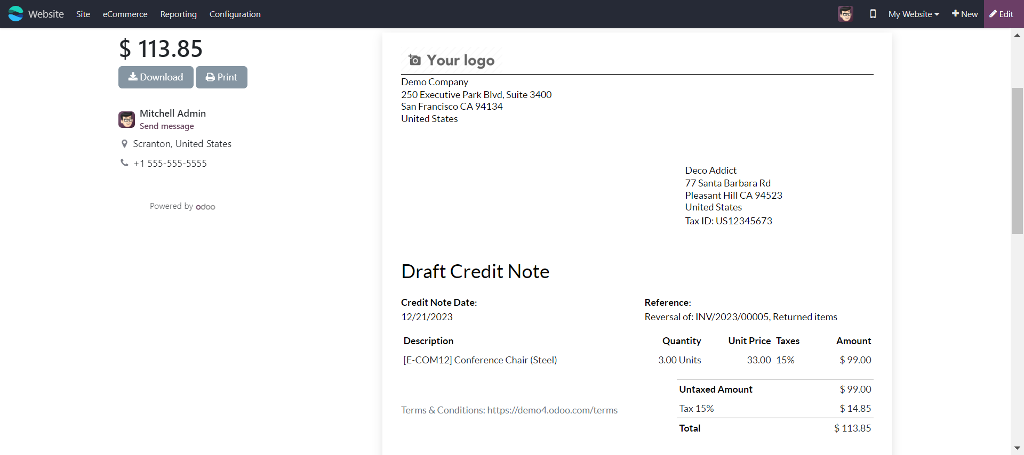

1. Online payment and credit notes

When a customer has a credit balance from a credit note, they can use it as an online payment method to pay for future purchases or outstanding invoices. Simply select the credit note as the payment method during checkout or when recording a payment against an invoice.

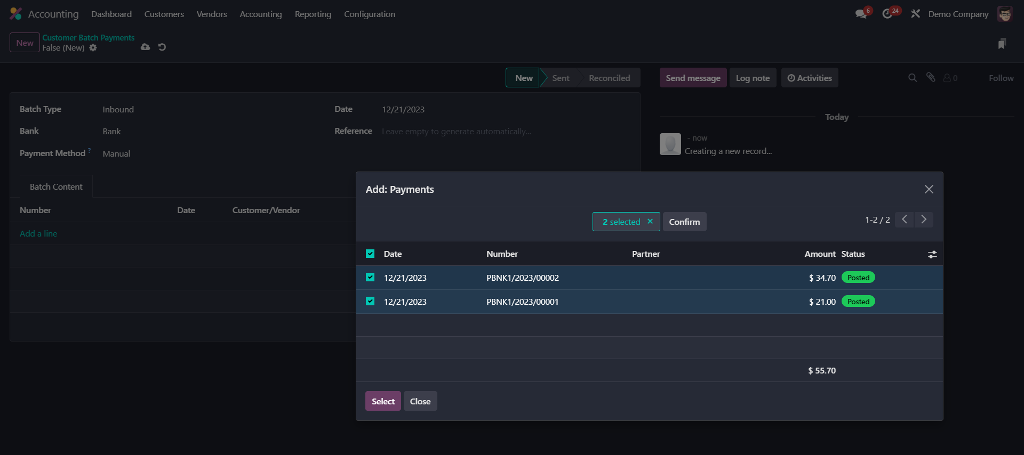

2. Batch payment and check printing

Batch payment allows you to group multiple invoices or vendor bills and process them as a single payment. This feature is particularly useful when you have multiple invoices to pay to the same vendor or when you want to make bulk payments to multiple vendors.

Once you have created a batch payment, you can choose to print checks for the selected invoices or bills. Odoo Accounting provides check-printing functionality that allows you to generate and print checks directly from the system.

3. AI-powered invoice recognition and digitalization

Businesses in many countries, like Singapore, are recommended to apply for e-invoicing to take part in the new government initiative. The feature is useful to improve paperless business efficiency and reduce costs and mistakes.

Odoo configures AI to generate electronic vendor bills or customer invoices automatically based on your scanned paper documents or PDF file. This reduces manual data entry and minimizes the chances of errors in invoice details including line items, quantities, prices, and taxes.

Following your local regulations has never been this easy. Contact us for custom localization today.

Save time with Odoo Accounting automation features

What do accountants value most in accounting software? Besides increasing data security, they expect automation to eliminate manual work while reducing errors. Understanding that, Odoo continuously develops its financing modules, like accounting, to be more optimal with automation actions, making your accountants happier.

- Invoicing Automation and Tracking: Odoo Accounting allows you to automate the creation and sending of invoices based on predefined rules. You can set up recurring invoices, automatically generate invoices from sales orders, and schedule invoice reminders. You can also track the status of your invoices to gain real-time updates on invoice payments, overdue invoices, and outstanding balances.

- Chart of Accounts: Odoo Accounting provides a flexible and customizable chart of accounts that allows you to organize and categorize your financial transactions according to your business needs.

- Automated Bank Feeds: Odoo integrates with many banks and financial institutions, allowing you to import your bank statements directly into the system. This automation saves time and reduces the need for manual data entry.

- Budgeting and Forecasting: Odoo Accounting allows you to create budgets and forecasts for your business. You can set financial targets, monitor actual performance against the budget, and make informed decisions based on the analysis.

Interconnecting Odoo for accounting purposes

In inventory valuation, we brush a little about how the data in the Inventory module can be seen in the Odoo Accounting Software. There is more; let's discover how an all-in-one Odoo ERP system boosts your whole business operations with its powerful integration.

1. Full-integrated Odoo apps in accounting operations

Sales, Purchase, Invoicing, and Inventory

In the grand scheme of the supply chain, like in a retail store, the interconnection between accounting and the four modules becomes a necessity.

Directly in the Purchase and Sales apps, you can create vendor bills and customer invoices, respectively, and the entries will be automatically recorded in Odoo Accounting. The inventory valuation of stock in and out will be well-tracked, providing a comprehensive view of cash flow and outstanding balances through the accounting module.

Odoo Accounting is also integrated with CRM and POS modules to enable you to generate sales orders and customer invoices directly in those modules without going back and forth. At the end of the day, your accountants can check all sales invoices seamlessly within a single platform.

Project

The project module allows you to create projects and define tasks. Each task can have associated costs, such as labor, materials, and expenses. These costs can be tracked and recorded in the Project module, which will be reflected in Odoo Accounting’s journal entry.

In the same module, team members can log their working hours against specific tasks. These timesheets can be used to track the time spent on a project and can be linked to the accounting module for accurate cost calculation.

Payroll

Thanks to the integration of the two modules, businesses can streamline their HR and payroll processes, automate financial entries, and maintain accurate employee-related financial records.

For instance, the Odoo payroll module enables you to calculate employee salaries, deductions, and benefits based on predefined rules and policies. Once the payroll is processed, Odoo Payroll generates payroll entries that capture the salary expenses and related liabilities. This data will then be reflected in the journal entry in the accounting module.

Learn more about how Odoo integration allows companies to manage their people while tracking expenses and managing payroll from a single dashboard.

Manufacturing

You can use the integration between manufacturing and accounting to track the journal entry to track production & labor costs. After creating a manufacturing order in the Manufacturing module and having it processed, you will get data on raw materials, the work in progress, and the finished goods. Then, you can view the reports for the manufacturing process, such as the inventory valuation, the profit and loss, and the balance sheet in the accounting module.

Learn more about how manufacturing industries can benefit from Odoo integrations.

2. Additional third-party integrations:

Website Builders

Odoo can also connect with various third-party website builders, such as Wix, Joomla, WordPress, DotNetNuke, and others. Even if your business works in the service industry like a healthcare provider, you can still enjoy the integration of Odoo accounting, CRM, and website.

The customer portal allows customers to manage their transaction details in one place. They can receive and confirm the quotations, as well as receive invoices directly from your website. Thanks to that, accountants can track the status of your invoices, such as paid, unpaid, overdue, or refunded, and get real-time insights into your cash flow without obstacles.

E-commerce applications

You can also integrate with e-commerce platforms, such as Magento, Prestashop, or Shopify. The integration enables automatic synchronization of sales orders and invoices between the e-commerce platform and the accounting system.

The pandemic teaches us that bringing your business online is crucial to staying connected to your customers, wherever they are, whatever the circumstances. Interested in turning your physical store into an e-commerce store? Learn more about things to consider before creating your online store here.

Various online payment methods

With the integration between Odoo and multiple payment gateways, you can accept online payments from your customers. Configure and connect popular payment providers such as PayPal, Stripe, Authorize.net, and more. This way, your customers can make secure online payments directly from your Odoo platform.

Odoo Accounting offers a wide range of connectors and APIs that allow you to integrate with other external systems, such as banking platforms, tax software, reporting tools, and more. That way, your business can be sure that your accounting data can stay connected and up-to-date across multiple systems.

Achieve great things with Odoo Accounting software

Imagine a year of bliss after your company integrates Odoo Accounting to increase efficiency in invoicing and bookkeeping processes. Enjoy the elevated experience of accounting by creating and sending professional invoices, tracking payments and expenses, generating reports and insights, and integrating with other Odoo modules and third-party services. Customize your accounting system with Odoo to fit the way your company does business.

Join many other companies that improved their cash flow, reduced errors, increased productivity, and enhanced compliance after upgrading their accounting systems. Businesses big and small can save time and money by automating and streamlining accounting processes and focusing on growing their business and satisfying customers. Its scalability and the great user experience, make Odoo a highly sought-after ERP system that is suitable for any business size and industry.

Don’t miss this opportunity to take your business to the next level with Odoo for accounting. Portcities has a team of experts who can help you with implementation, customization, migration, training, and support. We can also provide you with other Odoo solutions, such as CRM, inventory, e-commerce, and more. Elevate your Odoo for accountants, today.