When the Singaporean government launched a nationwide E-invoicing network in 2019, the reason was simple - to improve business efficiency and reduce costs. While a lot has changed since then, the goal hasn't.

Among the change is that the e-invoicing network has been renamed InvoiceNow since September 2020, and now a couple of grants are up for grabs for businesses who align with the Singaporean government's initiatives to use the Peppol network to accelerate e-invoices’ adoption.

Before getting to the grants, let’s discuss what e-invoicing is, its benefits, Peppol, and how your business can benefit.

What is an E-invoice?

An e-invoice or electronic invoice is an invoice that is electronically delivered in a specific and standardised format.

It contains a visual representation of the invoice data in a structured form. It can also be automatically imported into the buying business’s accounting system.

It is important to note that e-invoices are not:

Images of paper invoices in formats such as .jpg or .tiff or sent via fax machines.

Scanned paper invoices - through Optical Character Recognition (OCR).

Unstructured Invoice data in word or PDF formats.

Unorganized HTML invoices in an email or on a web page.

What is E-invoicing?

E-invoicing or electronic invoicing happens when a paperless invoice is exchanged between a buyer and a seller through a predefined electronic data exchange.

In today’s world, e-invoicing is enabled through two main options. The first is a direct connection between the seller and buyer.

The second option involves a network of multiple sellers and buyers.

This is what is at play in Singapore. With the effort of the IMDA (Info-communication Media Development Authority), a statutory board under the Singapore Ministry of Communications and Information, the Singaporean government implemented the first nationwide e-invoicing network under the Peppol authority outside of Europe.

The International Peppol E-Delivery Network allows businesses to transact internationally with other linked companies.

And now, businesses in Singapore can benefit from e-invoicing in the Peppol network with other companies in and outside Singapore, provided both parties join the network.

Benefits of E-invoicing

Increases Cash Flow

Because e-invoices are delivered immediately to the necessary quarters, the time to payment is shortened, which improves business cash flow.

Reduces Cost

With paper invoicing, businesses commit more resources to storage and retrieval, increasing business costs. E-invoicing reduces this cost.

Improves Business Efficiency

E-invoicing greatly reduces the chances of human error and delays in invoice submission. This, in turn, increases accuracy and business efficiency.

Enables Higher Compliance

E-invoicing isn’t just a medium to fill digital invoices; it is more than that. E-invoicing allows businesses to reach a higher level of compliance without hassle.

Provides Transparency and Visibility

E-invoicing provides better transparency because it tracks invoices and gives in-depth audit trails. It also improves visibility into invoices, contracts, purchase orders, and supporting documentation.

Boosts Employees’ Morale

With e-invoicing, the workforce has fewer things to worry about as the other party will get the invoice quickly, and they can save time and focus on other high-value tasks.

What is Peppol E-invoicing in Singapore?

Peppol e-invoicing in Singapore is a part of the global Peppol e-invoicing network. Many European countries, like Germany, Britain, and Norway, use the Peppol framework to facilitate the electronic exchange of business documents.

It also enables businesses to communicate electronically with public buyers, including exchanging electronic invoices via the Peppol network.

As the Peppol authority in Singapore, IMDA approves and certifies Peppol access points and Peppol-ready solution providers.

At the time of its launch, the e-invoicing network had 11 access point providers and only a few businesses that were Peppol-ready solution providers.

Today, because of the benefits businesses gain from being compliant, InvoiceNow, Singapore’s e-invoicing network official name, now has over 150 Peppol-ready solution providers - one of which is Port Cities Singapore.

Other functions of the IMDA include specifying the SG Peppol BIS specifications, governing network compliance, and promoting e-invoicing adoption.

Want to reduce costs & improve payment processes with InvoiceNow?

How does E-invoicing Work in Singapore?

Before IMDA, companies issued invoices after extracting the necessary information from their ERP/accounting systems and formatting them into a human-readable format. Once done, they send the invoices through paper or email.

You would agree it isn’t the best approach, but the receiving companies don’t do better either.

The receiving companies manually enter the information or scan it into their systems - an error-prone, time-consuming, and resources wasting approach.

InvoiceNow speeds up invoice processing by directly transmitting the e-invoices from one accounting system to another, aiding faster payment.

It does that through the XML document format known as BIS (Business Interoperability Specifications) Billing 3.0 UBL.

This standard makes it possible for businesses (both buyer and seller) to use their chosen ERP/ accounting system for e-invoicing purposes without their counterparts using the same system. This is possible once the systems on both sides meet IMDA’s requirements.

Due to its convenience, many businesses are Peppol-verified users. You can find a list of businesses in the Singapore Peppol directory by visiting https://www.peppoldirectory.sg/.

Difference between Peppol-ready and Access Point Providers

Peppol-ready solution providers are systems such as an ERP or Accounting solution able to send and receive e-invoices across the Peppol network.

Aside from e-invoicing capabilities, the solution must also guarantee the correctness of Peppol IDs of business partners. Information on registering the system as a Peppol-ready solution can be found here.

On the other hand, the access point or service providers create and maintain connectivity gateways on the e-invoicing network.

They must stay compliant with the Peppol standards, register and update users’ details in the Singapore Service Metadata Publisher (SMP), and route e-invoices to the right destination.

More information on how to be an access point provider in Singapore can be found here.

Current Grants from the Singaporean Government

The Singaporean government is poised to accelerate the adoption of the e-invoicing network. Through the IMDA, they have introduced the following grants:

InvoiceNow Transaction Bonus (ITB)

The ITB is a $200 bonus available to all businesses once they send ten invoices on the InvoiceNow network within the first 12 months of the first invoice.

Once a business sends the first invoice, regardless of the amount, the IMDA pays them $50. An additional $150 is paid once they send the remaining nine invoices.

To get started, you must register on the network through a certified Peppol-ready solution provider like Port Cities. Afterward, you can find your customers on the Singapore Peppol directory and retrieve their Peppol ID information.

Once that is done, you can use your preferred ERP/ accounting system to send them an invoice, provided it is registered on the network with the help of an Access Point provider.

LEAD Connect & Transact Grant

This grant is in two folds, the LEAD Connect and the LEAD Transact grants. They are both applicable to big enterprises only.

LEAD Connect Grant

Large organizations with their ERP/ finance solution can access a $30,000 grant through the LEAD Connect grant.

There are a few eligibility requirements to meet:

The enterprise must have active and valid business UENs.

They must complete the integration to InvoiceNow with their finance system within 12 months.

The integration process must begin after 1st November 2022.

They must have at least 200 suppliers and customers.

LEAD Transact Grant

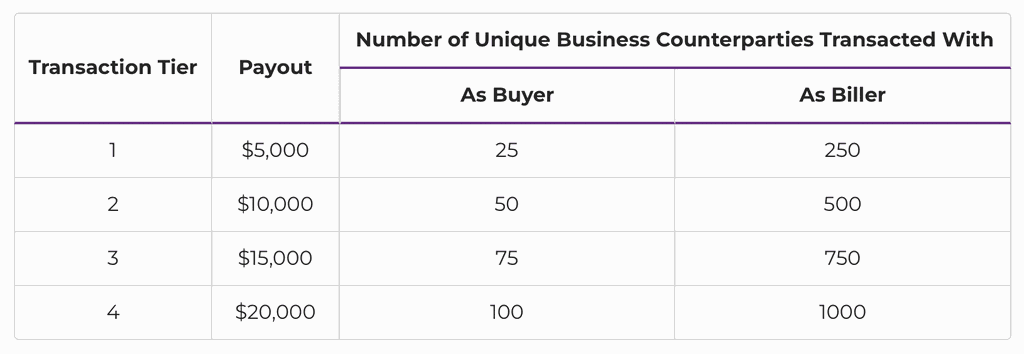

Enterprises eligible for the LEAD Transact grant can get up to $40,000. They can also receive incentives as both biller and buyer.

Eligibility criteria:

Large enterprises that can meet the minimum transaction tier of 25 UENs as buyers and/or 250 UENs as billers.

The funding period is a year after the first claim, and the starting dates as biller or buyer don’t have to be the same.

Billers getting the LEAD Transact grant are exempted from the InvoiceNow Transaction Bonus.

The table below shows the transaction tiers that enterprises can fall into and the corresponding payouts.

You can find more information on registering and the terms and conditions here.

Integration with an ERP/ Accounting solution like Odoo is key

Odoo is a modular ERP that started in 2005 to help businesses improve their processes through technology.

Today, Odoo is one of the leading Enterprise Resource Planning (ERP) solutions, with over 7 million users and hundreds of applications and modules.

Among these are the Accounting, Inventory, CRM, Website builder, Sales, and so much more - all of which share data seamlessly once installed.

Through its Accounting application, Odoo is helping businesses in Singapore stay compliant with the new IMDA e-invoicing requirements.

Aside from its superior accounting features and instant connectivity with other Odoo apps, Odoo Accounting serves as an excellent investment to any business in Singapore because of the following reasons:

IRAS Requirement Compliant

Decision-making becomes seamless

Integration with other Odoo apps

Localization in other countries

Get Started with E-invoicing

The benefits of e-invoicing cannot be overemphasised. Businesses can operate more transparently, save money, and work with more cash flow.

However, businesses in Singapore have an added advantage with the Peppol-backed InvoiceNow.

While joining the network isn't mandatory at the time of this writing, it is right for businesses, regardless of size and industry, to embrace e-invoicing.

We can assist you whether you have previously used an accounting system and want to register on InvoiceNow, or are looking to get started.

Port Cities Singapore comprises experts who can help you integrate Odoo Accounting with Peppol and answer further questions on e-invoicing and applying for government grants.

Drop us a message, and a team member will be in touch as soon as possible.