Vietnamese Payroll & Attendance Software

Our Vietnamese Payroll & Attendance Software helps companies improve attendance accuracy and calculate payroll in compliance with the Vietnamese Labor Code and company regulations in only under 7 minutes. Over 200 employees with night shifts? Say goodbye to manual validation and payroll calculations that waste time!

Best Features of Vietnamese Payroll Software

Statutory Compliance

The Vietnam Payroll software helps the HR team set up salary calculations and implement the HR procedures accurately for each employee, in compliance with the Vietnam Labor Code, including rules regarding PIT, shifts, overtime, leaves, social insurance, dependents, etc.

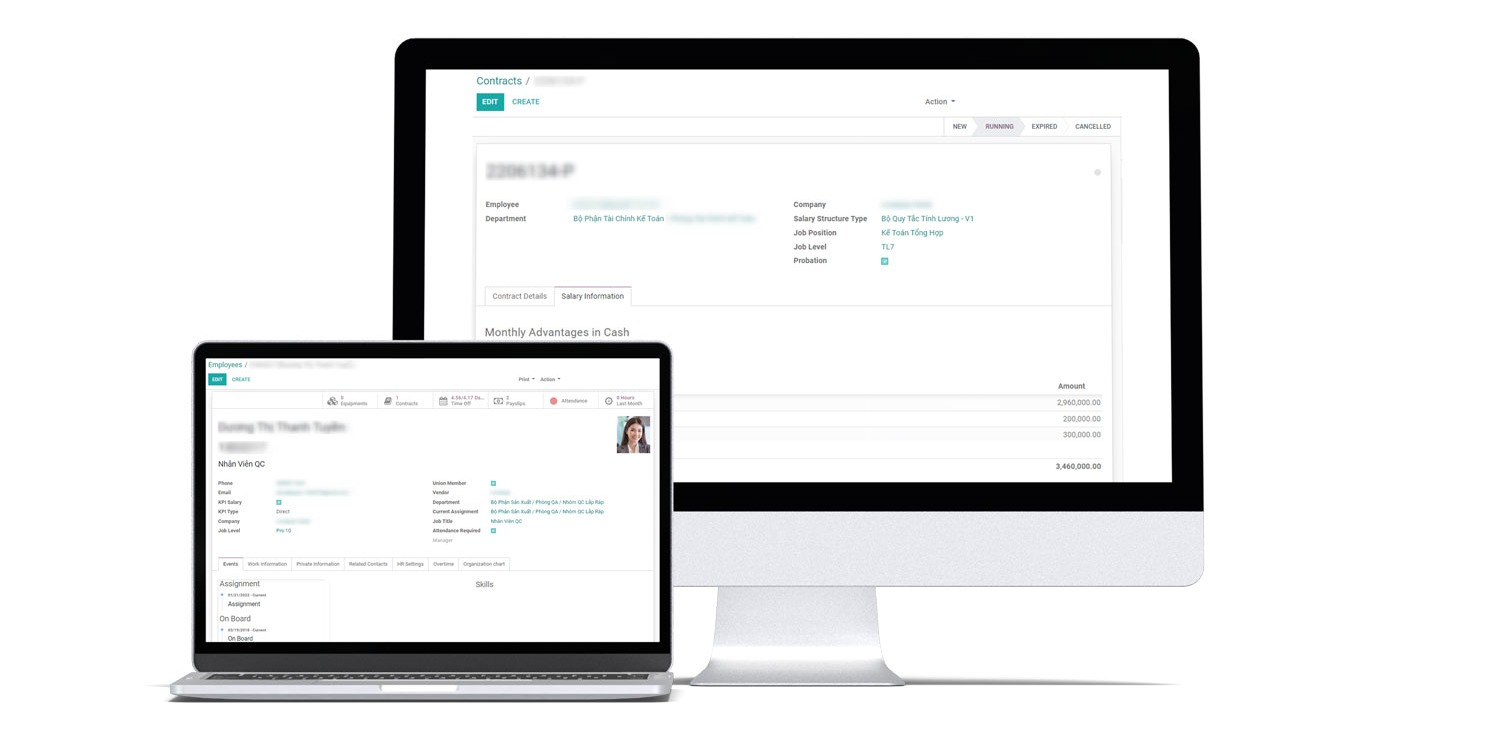

Payroll Calculations from Different Contracts

Different employees have different types of contracts. The solution takes this into account. You simply input the employee details along with their contract type, and their payroll calculation is done.

Automatic Payroll Calculation

It can take five personnel three days every month to manually validate 600 employees per Vietnam payroll rules and regulations. Our Vietnam Payroll solution saves hours as payroll is done automatically once all the information is correctly entered.

Payslip/Report Generation

Generate dynamic reports and payslips to partners and regulators including the Vietnam Tax Department and Social Insurance Agency (Tong Cuc Thue).

Integration between Payroll and Accounting in real-time

Data from the Vietnamese Payroll module is integrated with other Odoo modules such as Accounting, Sales, Purchases, etc. You can import data from other Odoo HR modules such as Sales, Appraisal, and KPI and calculate sales and performance bonuses into payroll.

Incorporate company rules and conditions

The Vietnamese Payroll & Attendance software also helps companies build their rules and conditions to the payroll software. These conditions include but are not limited to wages rates, allowances, specific employment agreements, etc.

Save time calculating payrolls + stay compliant with Vietnam's Labor Code.

Who is the Vietnamese Payroll Software for?

The Vietnam Payroll System is for you if you:

Have more than 100 employees.

Have multiple shifts or overtime and specific company rules applied in your payroll calculation.

Have trouble complying with Vietnam Labor Code.

Want to save time and resources in calculating payroll.

Connect with our Support

team to:

✓ Get all your inquiries answered

✓ Explore which package is best for you

✓ Get your software managed the right way

Frequently Asked Questions

The Vietnam Payroll & Attendance System considers and configure the Labor Code requirements in compulsory payrol calculations into Odoo, including probationary periods, mandatory workplace rules and notice periods, paid vacations, sick leave, maternity, and parental leave.

Included in the Payroll solution is an attendance management system that can validate as many rules as the company has regarding how attendance is monitored in your factory or company.

The second set of rules are those specified in the Vietnam Labour Code, such as salary rules, probation period, basic salary, tax & social insurance, maternity leave, and so on, which are configured in the system.

When a worker switches from one contract, for example probation, to another, like full-time contract, the Payroll System automatically applies the right set of rules in payroll calculation once the change has been set up for the employee.